Custom Shields

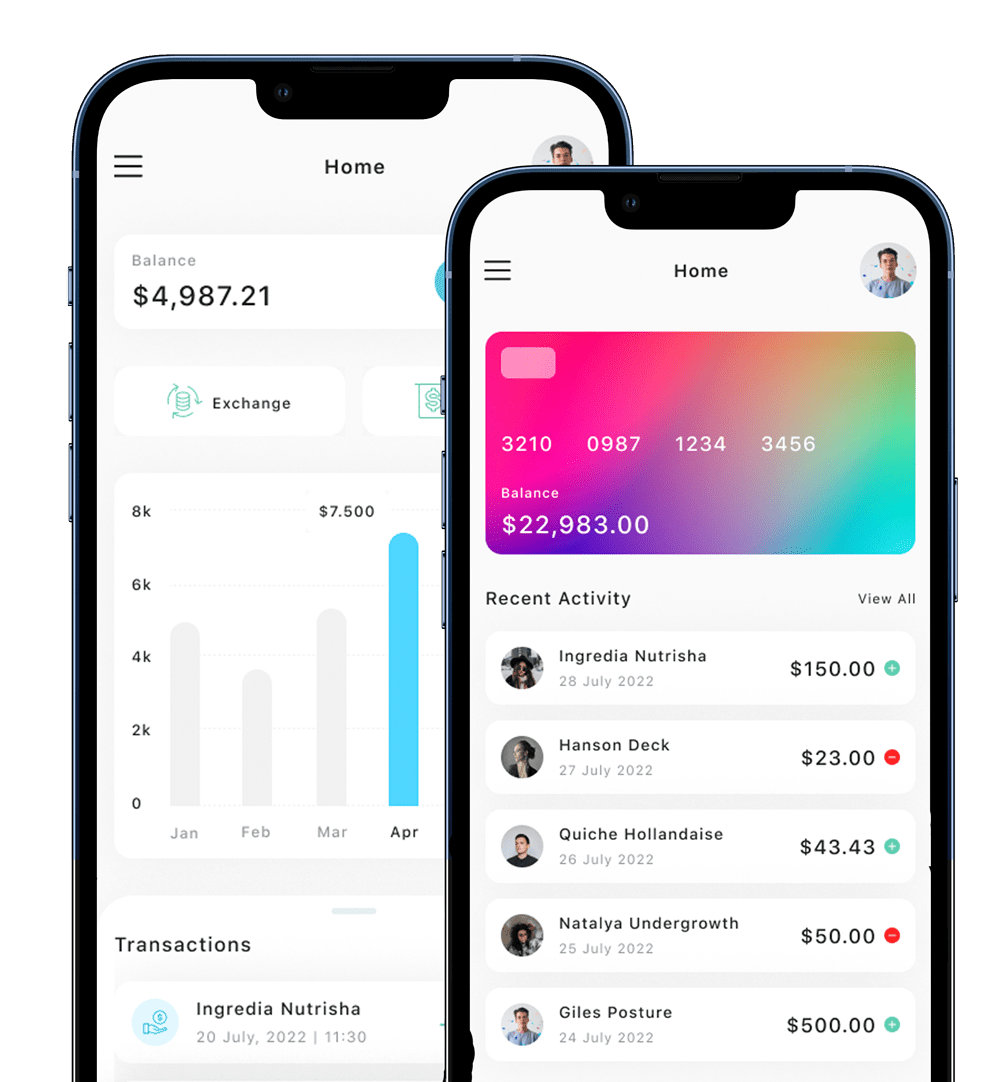

Make your Payment Method Simple and Easy with Custom Shields

Manage your payments via a simple API. Our robust platform tools help you operate transactions efficiently.

The platform matches the best payment connectors based on payment pain points, compliance, volume, and merchant success rates, and achieves full optimisation through intelligent connector routing, ensuring a secure payment experience for market exploration.

An all-in-one business account for online payments

- Process Optimisation

- ROI Optimisation

- Cost Optimisation

- Fraud Optimisation

- Unified Reconciliation

what we support

- Tobacco & Cigar

- Skin & Hair Care

- Dating

- Sports Betting

- Vape / e-Cig / e-Juice

- Online Gambling

- Online Gaming

- Adult

- Nutraceuticals

CONNECTORS INTEGRATION

Build world of payment methods for you

Our mission is to integrate hundreds of connectors and share them with our clients, optimise them through technological innovation, and help you reach the markets you want with ease.

Connectors Development

Our goal is to develop and integrate over 100 connectors, including banks, acquiring banks, gateway companies, risk firms, cross-border platforms, logistics providers, and other payment-related service providers, with all connectors fully open to customers.

Connectors Sharing

We thoroughly gather and analyse connector data from each access platform—including application processes, success rates, risk, compliance, and costs—and share this information with our customers. This solves poor channel insights and helps you quickly match the ideal connector for your business.

Connectors Optimisation

Our system flexibly configures connector routing based on your payment pain points, success rate, cost, region, and other factors, optimising connectors to maximise success and reduce costs.

- lframe payment pages

- Hosted payment pages

- Direct API

- Connectors integration

- Connector smart routing

- Risk Management

- White-labelled API Specs

- Merchant Integration Support

- Full Dav Initial System

- Financial Reconciliation

RISK MANAGEMENT

Eliminate fraud, grow revenue

Flexible rules are a key feature of our risk management. Our credit system calculates a score for each buyer to verify user identity, and our risk engine conducts a comprehensive early-warning scan of transactions combined with an alert system.

Flexible Rules

Supports flexible configuration of risk models and rules across multiple dimensions (including behaviour, 3DS, etc.).

Credit System

Calculates a credit rating for each buyer using advanced methods, and supports flexible application of the credit system to risk rules, controlling fraud and reducing transaction rejections.

Flexible 3DS

Supports flexible decisions on whether to verify 3DS based on the risk profile of each transaction.

Risk Alert

Our alert system enables customised notifications across various dimensions, supporting email, SMS, or telephone alerts for timely action by the responsible team.

Subscribe Our Newsletter

Leave your email to receive latest offer and news.

The Company

TTR IT Holdings Limited

- 367 - 375 QUEEN'S ROAD CENTRAL, SHEUNG WAN, HONG KONG

- UNIT 1603, 16TH FLOOR, THE L.PLAZA

- +1 (251) 3208580

- [email protected]

Copyright © 2024 TTR IT Holdings All rights reserved.