Merchant Accounts

Know Your Business (KYB): Ensuring Compliance and Thorough Investigations

Cashields has built its KYB platform on extensive experience in merchant due diligence. Created by expert underwriters, it delivers faster results, better onboarding decisions, and boosts your team’s efficiency.

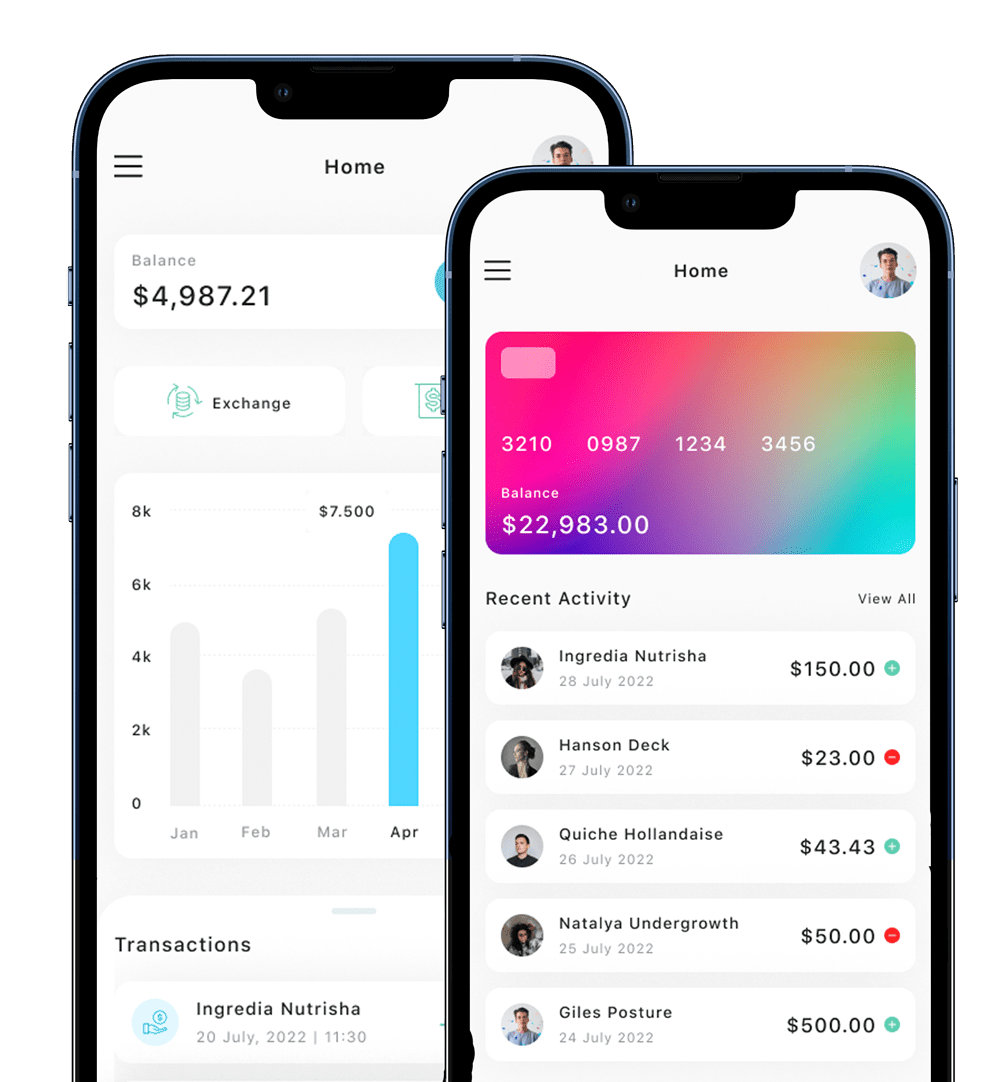

An all-in-one Merchant Account

- Underwrite large merchant portfolios efficiently through automation, even for smaller teams

- Every tool an underwriter requires, smartly integrated into one dashboard

- Our team continually refines the platform and updates it with the latest card scheme rules

- Quantified risk scores and traffic-light color coding render complex data clear and actionable

TYPICAL CARD SCHEME RULES VIOLATIONS

There are a myriad of risk indicators tied to card scheme violations that Cashields detects automatically. Here are some of the most important ones for Know Your Business (KYB) organisations.

1. Content violations and illegal offerings

Merchants must not sell illegal or brand-damaging products or services. To ensure compliance, Cashields’ web crawler scans all known merchant websites for content that breaches this rule.

2. Missing website information

eCommerce merchants must display clear details about the operating company, payment terms, and more to comply with card scheme rules. Cashields automatically detects any missing information and presents it for review.

3. Negative options merchants and deceptive marketing

Recently, Mastercard and Visa have enforced strict rules to curb negative option practices, ensuring consumers aren’t charged for unwanted products or services. Payment processors require merchants to operate transparently with clear free trial and subscription terms.

ONE STEP CLOSER TO HOLISTIC RISK MANAGEMENT

Cashields’ KYB solutions are designed to integrate seamlessly. Combine them with Monitor or leverage our high-risk merchant compliance tools to elevate your portfolio risk management.

MERCHANT MONITORING

1. Proven Card Scheme Compliance

Cashields is an authorized Mastercard Merchant Monitoring Service Provider. Our clients benefit from prompt mitigation in cases of non-compliance.

2. Continuous Merchant Monitoring

Automated monitoring is crucial for the long-term health and profitability of your merchant portfolio.

3. Fully Flexible Configuration

Customize Monitor to suit your requirements: set monitoring frequencies by risk category, adjust specific rules, and more.

4. Modular Design for Flexible Monitoring

Integrate Monitor with Cashields for an efficient monitoring framework and consistent data management.

HIGH-RISK MERCHANT COMPLIANCE

Achieve card scheme compliance and onboard safely.

Our underwriting and monitoring solutions are designed to handle most high-risk merchants, though certain industries require special card scheme rules.

Payment processors managing high-risk portfolios can earn high rewards—but only by staying compliant. We’re here to help.

Subscribe Our Newsletter

Leave your email to receive latest offer and news.

The Company

TTR IT Holdings Limited

- 367 - 375 QUEEN'S ROAD CENTRAL, SHEUNG WAN, HONG KONG

- UNIT 1603, 16TH FLOOR, THE L.PLAZA

- +1 (251) 3208580

- [email protected]

Copyright © 2024 TTR IT Holdings All rights reserved.